owner draw quickbooks s-corp

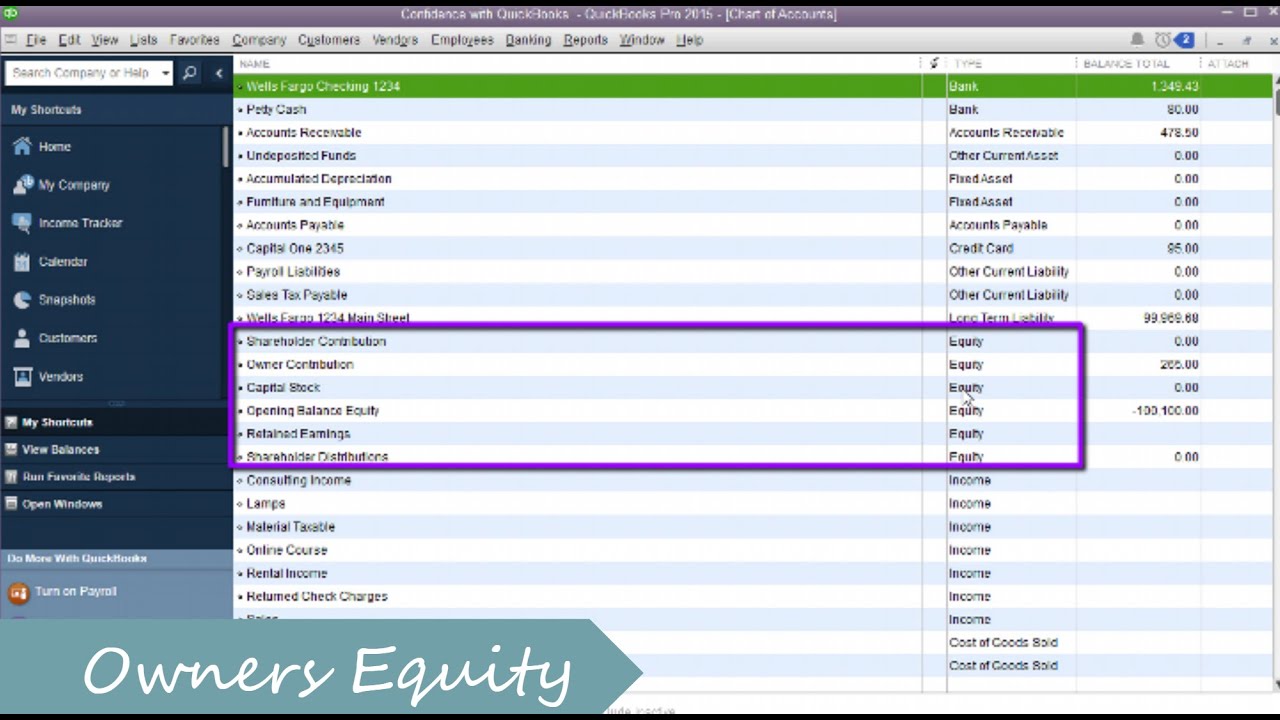

Choose Lists Chart of Accounts or press CTRL A on your keyboard. Visit the Lists option from the main menu followed by Chart of Accounts.

Solved Owner Has Been Incorrectly Taking Owners Draw Inst

The owners draw is accounted for differently than guaranteed payments.

. Make sure you use owners contributionsdraws. I have a new Client that is a 2 person C Corp 1120 with subcontractors that will all get 1099-Misc. Can trigger penalties from the IRS if your salary is considered.

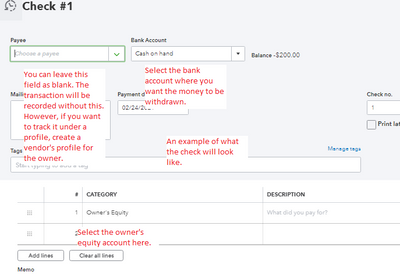

2106 no longer exists. Before you can record an owners draw youll first need to set one up in your Quickbooks account. A members draw also known as an owners draw or a partners draw is a QuickBooks account that records the amount taken out of a company by one of its owners.

Only a sole proprietorship a partnership a disregarded entity LLC and a partnership LLC can have owner draws. Click Account New at the bottom left. To open an owners draw account follow these steps.

According to IRS internal system those corporations that are elected to share the. Pros of an owners draw Owners draws are flexible. An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner.

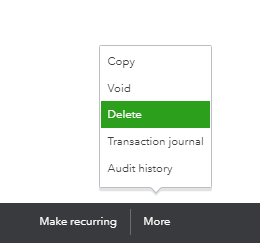

Click Chart of Accounts and click Add. Guaranteed payments are a business expense while an owners draw is not. How to Record Owner Draws Into QuickBooks Click the List option on the menu bar at the top of the window.

A owns 100 of the stock of S Corp an S corporation. The main type of transaction I have throughout the year that affects Owners Equity accounts is using personal accounts to pay for business expenses or vice versa. I need help please.

An owners drawing is not a business expense so it doesnt appear on the companys income statement and thus it doesnt affect the companys net income. Example 1. A is also Ss president and only employee.

Enter the account name and description Owners Draw is recommended When you are done hit on Save Close button. An owner of a sole. Being a business owner there is no need to confuse between corp and s corporations.

Because of this most S-Corporation owners try to choose a low but reasonable salary. And not employee expenses via 2106 means separating the S Corp mileage and turning that in for reimbursement. Write Checks from the Owners Draw Account.

Select the Equity account option. Jump to solution. A draw lowers the owners equity in the business.

Trigger payroll taxes. Create a Prior year draws account at the beginning of the next year. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner.

If youre a sole proprietor you must be. An owners draw is an amount of money an owner takes out of a business usually by writing a check. Heres the work around.

S generates 100000 of taxable income in 2011 before. They 2 owners did not start payroll until September. For tax purposes it often helps to know how much the owner has taken in draws for the current year.

An owners draw gives you more flexibility than a salary because you can pay yourself practically whenever youd like.

Solved S Corp Officer Compensation How To Enter Owner Eq

Owner S Draw Quickbooks Tutorial

Solved S Corp Officer Compensation How To Enter Owner Eq

Solved S Corp Officer Compensation How To Enter Owner Eq

Benefits Of Owning An S Corp Taking Distributions

How To Setup And Use Owners Equity In Quickbooks Pro Youtube

Drawing Demo Pencil Drawing Tutorials Drawings Face Drawing

Solved S Corp Officer Compensation How To Enter Owner Eq

6 Essential Words To Understanding Your Business Finances Business Finance Budgeting Finances How To Get Money

Quickbooks Owner Draws Contributions Youtube

Setup And Pay Owner S Draw In Quickbooks Online Desktop

S Corp Advantages Disadvantages The Complete Guide Amy Northard Cpa The Accountant For Creatives S Corporation Business Tax Small Business Tax

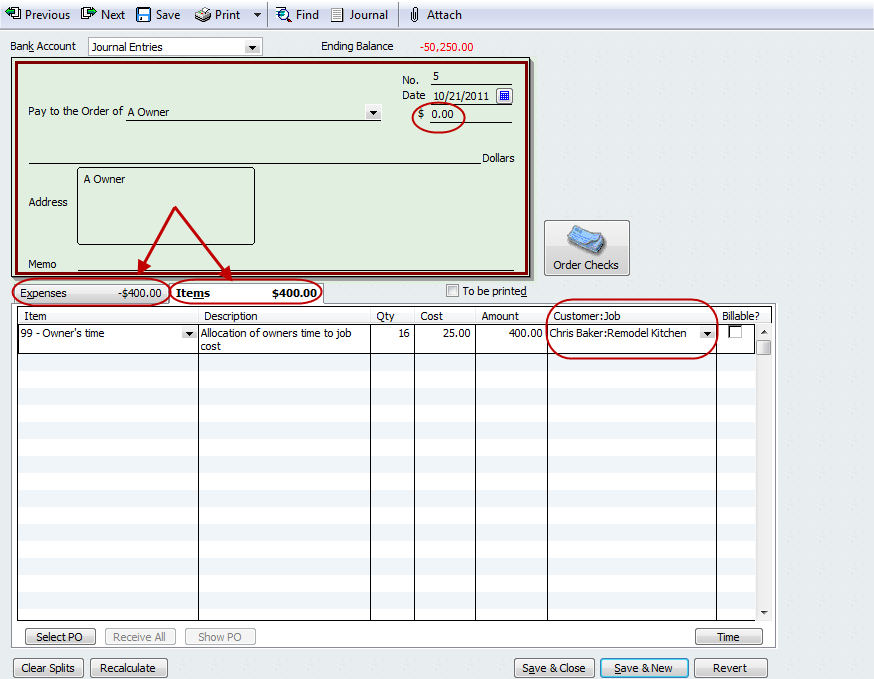

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

Question Can Owner Draw Be Greater Than Salary S Corp Seniorcare2share

Owners Draw Setup Quickbooks Create Setting Up Owner S Draw Account Qb

Quickbooks Online Tutorial Recording An Owner S Draw Intuit Training Youtube

6 Essential Words To Understanding Your Business Finances Business Finance Budgeting Finances How To Get Money